high iv stocks meaning

Typically you will see higher-priced option premiums on options with high volatility and cheaper premiums with low volatility. IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year.

:max_bytes(150000):strip_icc()/dotdash_INV_final-Profiting-From-Position-Delta-Neutral-Trading_Feb_2021-02-5e3940a27b30422bb071e5a53f386d05.jpg)

Profiting From Position Delta Neutral Trading

If you notice the IV of a stock before and after earnings its difference is huge.

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

. High IV strategies are trades that we use most commonly in high volatility environments. Make sure you can determine whether implied volatility is high or low and whether it is rising or falling. How much does IV drop after earnings.

The lower the IV is the less we can expect to. If IV Rank is 100 this means the IV is at its highest level over the past 1-year. Typically we color-code these numbers by showing them in a red color.

The prices are higher because the IV is very high. The IV drop depends mainly on the earnings results. It gives traders a way to measure potential risk and reward.

IV crush is the phenomenon whereby the extrinsic value of an options contract makes a sharp decline following the occurrence of significant corporate events such as earnings. This value tells us how high or low the current value is compared with the past. This expected volatility may be higher due to a variety of reasons like corporate announcements.

As an example lets say a stocks current IV is 35 and in 180 of the past 252 days the stocks IV has been below 35. Implied Volatility is the expected volatility in a stock or security or asset. Implied volatility rises when the demand for an option increases and decreases with a lesser demand.

IV Implied volatility doesnt predict which direction a particular security will move only how much it is likely to move in any direction. Its expressed as a percentage. When implied volatility is high we like to collect creditsell premium and hope for a contraction in volatility.

In simple terms its an estimate of expected movement in a particular stock or security or asset. Microsoft stock is currently trading at 100 per share. If a stock is 100 with an IV of 50 we can expect to see the stock price move between 50-150.

What is a high IV. The prices of options goes down. If the implied volatility is high the market thinks the stock has potential for large price swings in either direction just as low IV implies the stock will not move as much by option expiration.

Right now for example the Microsoft 100 call option that expires in about a month has an IV of 34. Unfortunately this implied volatility crush catches many options trading beginners off guard. High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year.

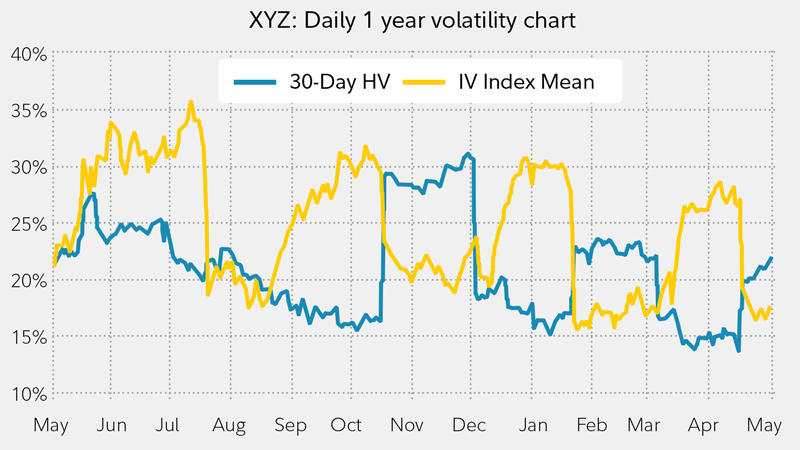

70 would mean that over the past year 252 trading days the current value is higher than 70 of the observations. Implied volatility is a measure of what the options markets think volatility will be over a given period of time until the options expiration while historical volatility also known as. For this reason we always sell implied volatility in order to give us a statistical edge in the.

Heres the formula for calculating a one-year IV percentile. It is a percentile number so it varies between 0 and 100. Historically implied volatility has outperformed realized implied volatility in the markets.

If the IV30 Rank is above 70 that would be considered elevated. The ranking is standardized from 0-100 where 0 is the lowest value in recent history and 100 is the highest value. IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past.

In the table above we can see that the implied. 2 How Implied Volatility Works. After earnings they start selling them and IV resets back to normal levels.

To option traders implied volatility is more important than historical volatility because IV factors in all market expectations. Learn how Implied Volatility IV can be a valuable tool for options traders to help identify stocks that could make a big price move. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account.

Fundamentally its a measure of the markets expectations for how risky that option is. What is considered to be a high Implied Volatility Percent Rank. Posted on May 1 2020 by Ali Canada - Options Trading Stock Market Training.

A high IVP number typically above 80 says that IV is high and a low IVP. The implied volatility is high when the expected volatilitymovement is higher and vice versa. Remember as implied volatility increases option premiums become more expensive.

Implied volatility percentile IV percentile tells you the percentage of days in the past that a stocks IV was lower than its current IV. Put simply IVP tells you the percentage of time that the IV in the past has been lower than current IV. An IV of 50 means that the market expects a volatility of 50 until option expiration.

IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its Implied Volatility history. Implied volatility is a statistical measurement that attempts to predict how much a stock price will move in the coming year. Talking about an option for a stock with a price per share at 100 indicates that the market expects -50 price movements per share.

By understanding both IV and IV rank you can determine the true nature of a stocks volatility. Traders should compare high options volume to the stocks average daily volume for clues to its origin. Implied Volatility percentile is a ranking method to compare implied volatility to its past values.

It is also a measure of investors predictions about future volatility of the underlying stock. The IV is very high because more calls and puts are traded in hopes of a large move.

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

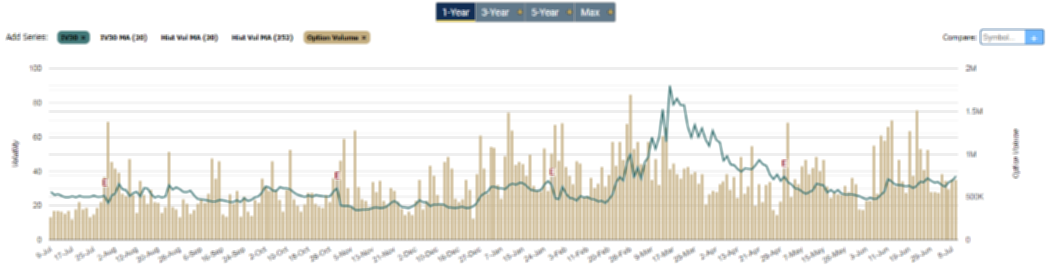

Spy Implied Volatility Chart Spdr S P 500 Etf Trust

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

:max_bytes(150000):strip_icc()/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)

Use Options Data To Predict Stock Market Direction

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

What Is Vega N In Finance Overview How To Interpret Uses

Spy Implied Volatility Chart Spdr S P 500 Etf Trust

Pokemon Go Appraisal And Cp Meaning Explained How To Get The Highest Iv And Cp Values And Create The Most Powerful Team Eurogamer Net

Take Advantage Of Volatility With Options Fidelity

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

What Is Volatility Definition Causes Significance In The Market

Trading Volume What It Is How It Affects Stocks Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

/skwesmile-56a6d2125f9b58b7d0e4f70a.gif)

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/skwesmile-56a6d2125f9b58b7d0e4f70a.gif)

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)